As of February 2013 a new fiscal code has entered into force in Romania. The new provisions are targeting small agricultural producers earning the majority of their income from cultivating cereals, technical plants, pomiculture and viticulture, and which “have the obligation to declare and to pay their annual income tax.”

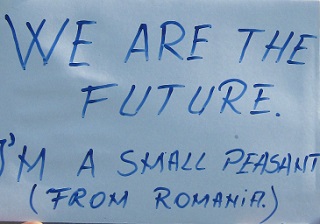

The new provisions are considered as beneficial by large-scale farmers which pay annual income taxes as any other enterprises, this being their chance to get rid of the unfair competition practiced by tax escapists. On the other hand, small producers who work their land for subsistence and who sell, mostly on a door-to-door basis, small quantities of surplus products will disappear; not being able to face the fiscal regime.

Almost 700.000 peasants will be hit by the Government’s new measures and the most surprising fact is the rapid process through which the proposal passed through the various decisional stages.

Pressuring the peasants in a context when Romanian agribusiness-man and foreign investors can scout benefits from an open-door policy seems rather mischievous from a governing coalition which includes a leftist party.

Taking account the taxation, combined with the fluctuations of the agricultural market, the measures will directly hit small and subsistence farmers. In fact, the smaller they are, the harder they will be affected, the bigger they are, the better they will resist. In reality the provisions place a subtle threat of bankruptcy over the small producers, discouraging and demotivating them to continue their lifestyle.

For example, the holder of 50 cows will have to pay 1650 Euro in taxes, based on the new income norms. Until the introduction of the new fiscal code, individuals with agricultural activities did not pay taxes, only 2% in case they sold their products to a legal entity. A family with 3 hectares of land, 150 chicken and 3 cows will either have to sell off 1 ha, 50 chicken and a cow, or pay all the taxes and social contributions towards the state.

The measure will not generate significant revenues to the state budget and it will not fight real tax evasion. Instead it will hit those that need protection and support: small farmers. Worse still, it will discourage them to keep practicing agriculture by adding red tape and payments. This will lead to a concentration of agricultural land into the hands of large-scale farmers. This is precisely what the National Bank of Romania envisioned and proposed.

It seems that a rural Romania bothers the government; just as traditions and saving things are perceived as a factor of political instability. If rural Romania is to change for better, then this must involve the rural communities and not banish them from their lands and lifestyles.