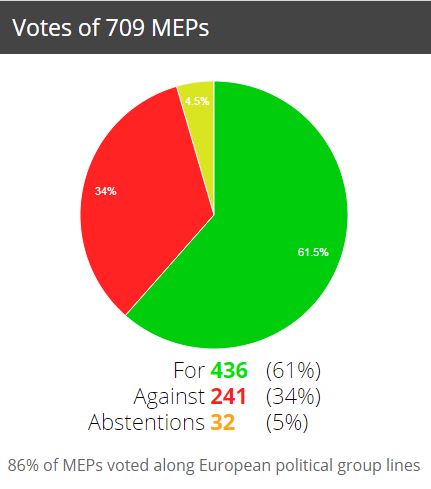

As the tenth round of Transatlantic Trade and Investment Partnership (TTIP) negotiations continue this week, its worth looking back at the non binding European Parliament TTIP vote on the 8th July.

This vote passed a resolution outlining the Parliament’s TTIP priorities and included a controversial amendment – amendment 117 – which instructs the European Commission to replace investor-state dispute settlement (ISDS) with another dispute settling entity.

The resolution passed by a wide margin of 436-241, while the ISDS amendment passed 447-229.

This amendment was a Socialist and Democrat group (S&D) and the European People’s Party (EPP) compromise, hatched by president of the Parliament Martin Schulz and presented by MEP Bernd Lange. This allowed a majority of the S&D group to vote for it. Here is the exact wording:

“To ensure that foreign investors are treated in a non-discriminatory fashion, while benefiting from no greater rights than domestic investors, and to replace the ISDS-system with a new system for resolving disputes between investors and states which is subject to democratic principles and scrutiny, where potential cases are treated in a transparent manner by publicly appointed, independent professional judges in public hearings and which includes an appellate mechanism, where consistency of judicial decisions is ensured, the jurisdiction of courts of the EU and of the Member States is respected, and where private interests cannot undermine public policy objectives.”

The S&D group remained divided, with a substantial portion of the group voting against. Almost all Austrians (except 1), all Belgians, almost all Bulgarians (except 1), all French, all Dutch, almost all Polish (except 1), all UK (except 1, David Martin) voted against. Also, 1 Croatian, 1 Czech, 9 (out of 30) Italians, 3 (out of 27) Germans, 1 Latvian, 1 Swedish and 1 Irish voted against.

EU Trade Commissioner Cecilia Malmstrom was delighted by the vote, which backs her concept paper on ISDS: *

“What today’s vote also signals is that the old system of investor-state dispute settlement should not and cannot be reproduced in TTIP — Parliament’s call today for a ‘new system’ must be heard, and it will be,” she said.

This supposed compromise on ISDS has been roundly criticised by campaigners however. Still, despite the hype and spin, “only foreign investors would have access, local investors, states or citizens won’t” as Ante Wessels pointed out.

Natacha Cingotti, Friends of the Earth Europe trade campaigner, said: “The parliament has backed dangerous propositions within TTIP such as special privileges for foreign investors and plans to permanently align existing and future rules between Europe and the US which would lead to lower environmental, food and safety standards.”

She expressly drew attention to the fact that MEPs have failed to come out against:

Keeping the ‘investor-state dispute settlement’ (ISDS) mechanism in the negotiations. Following a last-minute compromise amendment by President Schulz , the wording fails to challenge the granting of exclusive privileges to foreign investors. It gives a green light to the ISDS mechanism under another name, despite massive public opposition to its inclusion in TTIP.

The EU Commission’s plan for ‘regulatory cooperation’ under TTIP, despite public criticism and concern about its dangers. EU documents have revealed that regulatory cooperation will shift power away from elected national and EU decision makers towards a transatlantic body of unaccountable bureaucrats, with the power to scrutinise any new piece of legislation at EU or member state level. This would affect the ability of elected decision makers to regulate in the public interest, and unjustifiably increase the administrative burden of law-making .

Cecile Toubeau is a senior policy officer at Transport & Environment, criticised the weak wording in Euractiv.

“If this new system were going to be non-discriminatory, would this allow domestic investors to sue governments too? This new system would be another step towards completely undermining the domestic legal system.”

The proposed system calls on the respect of the EU and member state jurisdiction, however this is very difficult. Both the EU and the member states stand to lose power due to the very nature of specialised courts, which provide interpretation of European and national laws in private tribunals. Perhaps a new system could be construed that makes it compatible with EU law, and does not undermine the principles of the Court of Justice of the European Union (CJEU). However, this will be difficult, and may not provide a system with any added value for investors.

And now for the most important caveat; that the system cannot undermine public policy objectives. Is this even possible?”

In more detail, Ante Wessels lists five areas where this proposal is diplomatic blunder:

1: Only foreign investors have access to ISDS, local investors, states and citizens don’t;

2: No democratic context;

3: No workable instruments to correct expansive interpretations;

4: Specialised adjudication has a natural tendency to become expansionist;

5: The most used ISDS forum is rigged to the advantage of the United States

“Based on this resolution we could have a discriminating, expansive, and rigged ISDS system” Wessels concludes.

More

Arc2020 briefing notes on TTIP

What’s wrong with ISDS lite?

For an excellent and detailed overview of how groups and individual MEPs voted, visit Vote Watch.

*which, strangely, does not bear her name anywhere!